Industrial Robotics Market Size to Reach USD 163.9 Billion by 2033, Growing at 11.5% CAGR

Industrial Robotics Market is projected to reach USD 163.9 Billion by 2033, growing at a CAGR of 11.5% from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 30, 2025 /EINPresswire.com/ -- **Report Overview**

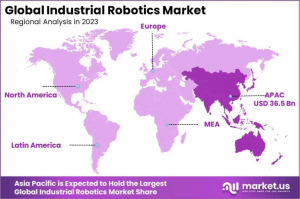

The Global Industrial Robotics Market is projected to reach USD 163.9 Billion by 2033, up from USD 55.2 Billion in 2023, growing at a CAGR of 11.5% from 2024 to 2033. In 2023, the Asia Pacific region held the largest market share, accounting for 66.2% of the total market, with a revenue of USD 36.5 Billion.

Industrial robotics refers to the use of robotic systems in manufacturing and industrial environments to perform tasks with high precision, speed, and consistency. These robots are typically automated machines equipped with sensors, actuators, and control systems to execute specific operations such as assembly, welding, painting, packaging, and material handling. The goal of industrial robotics is to enhance productivity, reduce operational costs, and improve safety by automating repetitive or hazardous tasks. Over the years, industrial robots have evolved from simple mechanical arms to highly sophisticated systems integrated with AI, machine learning, and IoT capabilities, allowing them to adapt to dynamic production environments.

The industrial robotics market encompasses the development, deployment, and maintenance of robotic solutions designed for a range of industrial applications. This market is driven by technological advancements, a push for operational efficiency, and the increasing demand for high-quality production standards. In addition, industries such as automotive, electronics, and consumer goods are adopting robotics solutions to maintain competitiveness and meet the growing demand for customized and scalable production lines.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/industrial-robotics-market/request-sample/

Several factors contribute to the growth of the industrial robotics market, including the rising labor costs, the need for precision in manufacturing, and the demand for faster time-to-market in production cycles. Furthermore, the increased adoption of automation technologies and Industry 4.0 initiatives is accelerating market expansion. The growing trend of reshoring manufacturing to reduce supply chain risks presents significant opportunities for industrial robotics adoption, providing an essential tool to enhance productivity and meet the evolving needs of modern manufacturing.

**Key Takeaways**

~~ The Industrial Robotics Market is projected to reach USD 163.9 Billion by 2033, growing from USD 55.2 Billion in 2023, at a CAGR of 11.5% from 2024 to 2033.

~~ In 2023, the Handling application dominated the market with a 41.3% share.

~~ The Electrical/Electronics sector led the end-use segment with a 26.3% market share in 2023.

~~ Asia Pacific held the largest market share at 66.2%, generating USD 36.5 Billion in revenue in 2023.

**Market Segmentation**

In 2023, the Industrial Robotics Market was dominated by the Handling application, holding a 41.3% share, as robots were widely used for tasks like material transfer, machine feeding, and packing to improve efficiency and cut costs. The Assembling & Disassembling segment followed with 22.7%, driven by precision needs in automotive and electronics industries. Welding & Soldering robots captured 15.5% of the market, essential in automotive and heavy machinery manufacturing. Cleanroom applications, crucial for pharmaceuticals and semiconductors, accounted for 8.4%, while Dispensing and Processing robots held shares of 6.6% and 4.8%, respectively. Specialized applications made up the remaining 0.7%, illustrating the growing and diverse role of robotics in manufacturing across various sectors.

In 2023, the Industrial Robotics Market was dominated by the Electrical/Electronics sector, which held a 26.3% share, driven by the need for precision in tasks like assembly and packaging. The Automotive sector followed closely with 24.8%, utilizing robots for welding, painting, and assembly. The Metal/Heavy Machinery sector accounted for 19.5%, focusing on heavy lifting and welding, while the Chemical, Rubber & Plastics industries made up 12.9% due to their demand for high precision. The Food sector contributed 8.2%, increasingly automating for safety and efficiency. The remaining 8.3% was spread across other industries like pharmaceuticals, textiles, and construction, underscoring the growing use of robotics across diverse sectors.

**Key Market Segments**

By Application

~~ Handling

~~ Assembling & Disassembling

~~ Welding & Soldering

~~ Cleanroom

~~ Dispensing

~~ Processing

~~ Others

By End-Use

~~ Automotive

~~ Electrical/Electronics

~~ Metal/Heavy Machinery

~~ Chemical, Rubber, & Plastics

~~ Food

~~ Others

**Driving factors**

Rising Demand for Automation and Efficiency

The global industrial robotics market is experiencing significant growth, driven by the rising demand for automation in manufacturing. Companies are increasingly adopting robotic solutions to streamline production, reduce labor costs, and enhance operational efficiency. As industries strive for higher precision, consistency, and faster output, robots provide an effective solution to meet these demands. This drive towards automation not only improves productivity but also supports the shift towards smart manufacturing systems.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=55415

**Restraining Factors**

High Initial Investment Costs

Despite the clear benefits of industrial robotics, the high upfront investment required for robotic systems remains a notable restraint. Small and medium-sized enterprises (SMEs) often struggle to justify the cost, especially when faced with tight budgets or uncertain returns on investment. The complexity of installation and the need for skilled labor to operate and maintain these systems further adds to the challenge, limiting the widespread adoption of robotics in some sectors.

**Growth Opportunity**

Expanding Applications in Emerging Markets

Emerging markets present a significant opportunity for the industrial robotics sector. With rapid industrialization in regions such as Asia-Pacific, Latin America, and Africa, there is a growing need for automation to meet production demands. As these economies advance, companies are increasingly seeking robotic solutions to boost productivity and remain competitive. This surge in demand for robotics in new markets provides substantial growth opportunities, particularly in automotive, electronics, and consumer goods industries.

**Latest Trends**

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) in industrial robotics is transforming the sector. Robots equipped with AI and ML capabilities can learn and adapt to new tasks, improving their performance over time. This shift towards smarter, more adaptable robots is enhancing the versatility of industrial automation and enabling manufacturers to respond more dynamically to changing production needs. These advancements are setting the stage for more autonomous and efficient robotic systems in the future.

**Regional Analysis**

Lead Region: Asia Pacific - Industrial Robotics Market with Largest Market Share of 66.2%

The global Industrial Robotics Market is significantly driven by regional dynamics, with Asia Pacific dominating the market in 2023, accounting for 66.2% of the total market share, valued at USD 36.5 billion. This region is experiencing rapid growth due to the increasing adoption of automation in manufacturing, particularly in China, Japan, and South Korea, where major industrial activities are concentrated. The demand for robots in automotive, electronics, and consumer goods manufacturing is propelling the market forward in Asia Pacific.

North America, the second-largest market, holds a significant portion of the market share, driven by advanced manufacturing technologies and high investments in automation, particularly in the U.S. and Mexico. North America is expected to maintain steady growth, fueled by innovations in AI and robotic systems.

Europe, while slightly smaller in market share, remains a key player in the industrial robotics space, with countries like Germany, France, and Italy leading the charge in automation integration within automotive, aerospace, and logistics sectors. The region's push towards Industry 4.0 is further expanding the market potential.

Middle East & Africa and Latin America are smaller markets, but they are showing gradual growth. The Middle East, especially the UAE and Saudi Arabia, is witnessing an increased focus on automation in oil & gas and manufacturing. Latin America is still in the early stages of adoption but is gaining momentum with rising investments in Brazil and Mexico.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, the global industrial robotics market continues to be dominated by key players such as YASKAWA Electric Corporation, Mitsubishi Electric Corporation, and KUKA AG, all of whom have established strong technological capabilities and extensive global presence. YASKAWA stands out with its advanced motion control technologies, while Mitsubishi Electric leverages its deep expertise in automation and robotics. KUKA AG and its subsidiary, KUKA Robotics, remain leaders in automation systems, particularly for automotive and manufacturing sectors.

Other significant players like FANUC, DENSO, and Panasonic also offer innovative robotic solutions that cater to a wide range of industries, driving automation and efficiency. Emerging players are focusing on specialized applications, increasing competition and market diversity. The rapid evolution of AI and machine learning technologies across these players is expected to propel further growth and transformation in the industrial robotics landscape.

Top Key Players in the Market

~~ YASKAWA Electric Corporation

~~ Mitsubishi Electric Corporation

~~ KUKA AG

~~ Comau SpA

~~ KUKA Robotics Corporation

~~ FANUC American Corporation

~~ DENSO CORPORATION

~~ Kawasaki Heavy Industries Ltd.

~~ Omron Corporation

~~ DAIHEN Corporation

~~ Seiko Epson Corporation

~~ Panasonic Corporation

~~ Epson America, Inc.

~~ Other key Players

**Recent Developments**

~~ In August 2024, KUKA launched a next-gen precision robot for electronics manufacturing, promising a 30% faster production rate due to enhanced speed and accuracy.

~~ In July 2024, Comau SpA formed a strategic partnership with a major automotive manufacturer to deploy advanced robotics, aiming for a 20% efficiency boost by year-end.

~~ In February 2024, FANUC introduced a robotic system for the food and beverage industry, expecting to cut production downtime by 25% with advanced diagnostics

**Conclusion**

The Global Industrial Robotics Market is poised for significant growth, projected to reach USD 163.9 billion by 2033, up from USD 55.2 billion in 2023, with a CAGR of 11.5% from 2024 to 2033. The market is primarily driven by the increasing demand for automation, enhanced operational efficiency, and technological advancements like AI and machine learning integration. Asia Pacific dominated the market in 2023, holding 66.2% of the share, largely due to the region's strong manufacturing base. While high initial investment costs remain a barrier, emerging markets and the continued adoption of robotics across industries such as automotive, electronics, and consumer goods offer substantial growth opportunities. Leading players like YASKAWA, Mitsubishi Electric, and KUKA are at the forefront of this transformation, fueling further innovation in industrial automation.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Manufacturing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release