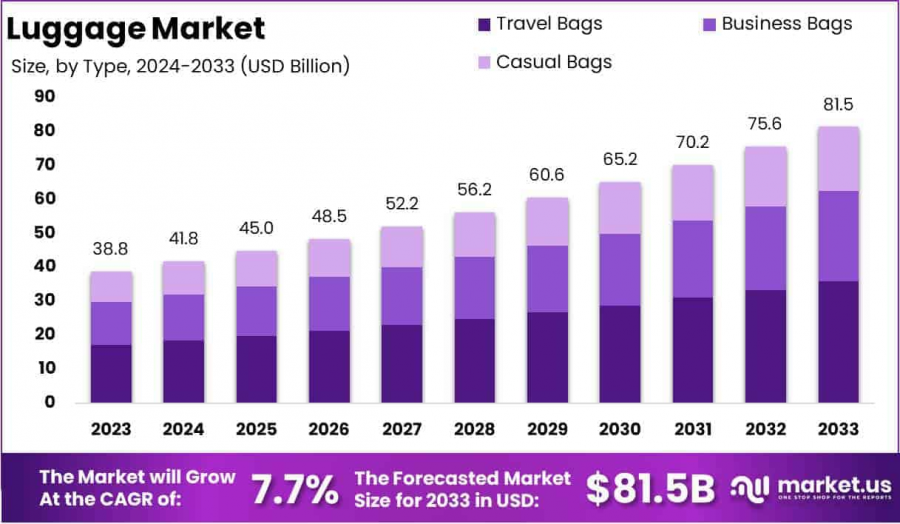

Luggage Market Size to Reach USD 81.5 Billion by 2033, Growing at a CAGR of 7.7%

luggage market is projected to reach USD 81.5 billion by 2033, growing at a CAGR of 7.7% from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- **Report Overview**

The Global Luggage Market is projected to reach USD 81.5 Billion by 2033, up from USD 38.8 Billion in 2023, growing at a CAGR of 7.7% from 2024 to 2033.

Luggage refers to a broad category of portable containers designed for the storage and transportation of personal belongings during travel. It includes suitcases, carry-ons, backpacks, duffel bags, and specialized travel accessories, each designed to cater to different types of travel, whether for short trips or extended vacations. Modern luggage has evolved in both design and functionality, incorporating materials such as durable polycarbonate, lightweight fabrics, and advanced security features, including biometric locks and tracking systems.

The luggage market encompasses the manufacturing, distribution, and retail of these products, serving a diverse range of consumers across the globe. The market has seen substantial growth in recent years, driven by the increasing frequency of international travel, a rise in disposable income, and heightened consumer demand for high-quality, durable, and stylish luggage solutions. The shift towards more personalized and tech-enhanced luggage, such as smart luggage with built-in charging capabilities and GPS tracking, has created new avenues for growth within the industry.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/luggage-market/request-sample/

Several factors are fueling this expansion, including the post-pandemic recovery of global tourism, the rise of experiential travel, and an increasing emphasis on convenience and functionality. Moreover, growing e-commerce penetration has made luggage products more accessible to consumers across different demographics. The demand is primarily driven by a combination of changing travel habits, technological advancements, and an increasing interest in premium products.

Opportunities lie in the development of lightweight, sustainable materials, as well as innovations in travel accessories. Additionally, the growing middle-class population in emerging markets presents a significant opportunity for manufacturers to tap into new regions and drive further growth.

**Key Takeaways**

~~ The global luggage market is expected to grow from USD 38.8 billion in 2023 to USD 81.5 billion by 2033, at a CAGR of 7.7%.

~~ Travel bags dominated the market in 2023, accounting for 44.2% of the total share, driven by increasing tourism and personal travel.

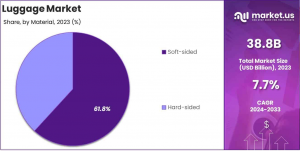

~~ Soft-sided luggage held the largest share at 61.8% in 2023, owing to its lightweight and versatile design.

~~ Offline retail channels captured 66.2% of the market in 2023, reflecting consumers’ preference for in-store shopping experiences.

~~ North America led the market with a 35.5% share in 2023, buoyed by a robust tourism sector and strong consumer spending patterns.

**Market Segmentation**

In 2023, the luggage market was led by Travel Bags, which held a 44.2% share, driven by increased demand for versatile, durable options for both short and long-term travel. Business Bags followed with 32.5% of the market share, fueled by the rise in business travel and the need for functional, stylish bags featuring laptop compartments and RFID protection. Casual Bags accounted for 23.3% of the market, benefiting from the growing popularity of lightweight, fashionable, and multipurpose bags for everyday use.

In 2023, soft-sided luggage led the market with a 61.8% share, thanks to its lightweight, flexible design and cost-effectiveness, making it a popular choice for short trips and domestic travel. Made from durable fabrics like nylon and polyester, it offers ample packing space, organizational compartments, and easy storage in tight spaces. Meanwhile, hard-sided luggage, known for its durability and protective qualities, held a smaller share but is growing in demand, particularly among travelers seeking security for fragile items and those opting for premium, modern designs. The rise of international travel and luxury experiences is expected to drive continued growth in the hard-sided segment.

In 2023, offline channels dominated the luggage market with a 66.2% share, driven by consumers' preference for in-store experiences that allow for direct product evaluation. Online channels captured 23.8% of the market, benefiting from the rise of e-commerce, offering convenience, competitive pricing, and variety, particularly among younger, tech-savvy shoppers. Supermarkets and hypermarkets contributed 15.6%, providing convenience and promotional discounts, while specialty stores accounted for 13.5%, attracting consumers with premium products and personalized service. The "Others" category, including department stores and local retailers, made up 9.7% of the market, still holding significance in regions with traditional shopping habits.

**Key Market Segments**

By Type

~~ Travel Bags

~~ Business Bags

~~ Casual Bags

By Material

~~ Soft-sided

~~ Hard-sided

By Distribution Channel

~~ Online

~~ Offline

~~ Supermarkets & hypermarkets

~~ Specialty Stores

~~ Online

~~ Others

**Driving factors**

Increasing Travel and Tourism Activity

The surge in global travel and tourism is a key driver for the growth of the global luggage market. As consumer confidence in post-pandemic travel rebounds, more people are taking vacations, business trips, and international flights. With the increased volume of air travel, consumers are seeking durable and innovative luggage options to accommodate their travel needs. This has led to higher demand for luggage that provides both practicality and style. Additionally, the growing trend of multi-generational family vacations and the rise of luxury travel contribute further to the expansion of the luggage market, as consumers invest in more specialized products like high-quality carry-ons and smart luggage. The upward trajectory of the travel industry directly supports luggage sales, with increasing disposable income in emerging markets also playing a role in driving demand for higher-end luggage options.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=16332

**Restraining Factors**

Rising Raw Material Costs and Supply Chain Disruptions

A significant restraint impacting the global luggage market in 2024 is the rising cost of raw materials and ongoing supply chain disruptions. The price hike in essential materials, including polycarbonate, aluminum, and high-quality fabrics, has increased manufacturing costs for luggage brands. This, combined with global logistics challenges and the after-effects of the pandemic, results in delays and higher production costs. Luggage companies are facing difficulty in managing the balance between price increases and maintaining affordability for consumers. Additionally, geopolitical factors have compounded the supply chain challenges, leading to unpredictability in product availability and shipment times. These issues may restrict the overall growth potential of the luggage market, especially in price-sensitive regions.

**Growth Opportunity**

Rise in Eco-friendly and Sustainable Luggage Solutions

The increasing demand for eco-friendly and sustainable products presents a significant opportunity for the luggage market. As consumers become more environmentally conscious, they are seeking sustainable travel solutions that align with their values. Luggage manufacturers are capitalizing on this shift by incorporating eco-friendly materials, such as recycled plastics and biodegradable fabrics, into their products. Additionally, brands are focusing on designing long-lasting luggage that reduces waste over time. The adoption of circular economy principles, where old luggage can be repaired or recycled, is also gaining momentum. The rise in eco-conscious travel is not only a trend but also a chance for brands to innovate and tap into a growing niche market, positioning themselves as leaders in sustainability within the travel and fashion sectors.

**Latest Trends**

Integration of Smart Technology in Luggage

The integration of smart technology in luggage is one of the most exciting trends driving market innovation. As consumers seek more convenience and enhanced security, the demand for tech-savvy luggage solutions continues to rise. Features such as GPS tracking, biometric locks, built-in charging ports, and digital scales are becoming increasingly popular in premium luggage offerings. These smart functionalities allow travelers to monitor their luggage's location, ensure better protection against theft, and streamline the travel experience. With the increasing use of mobile apps to manage luggage settings and connect to various travel-related services, smart luggage is becoming a must-have for tech-savvy and frequent travelers. This trend has the potential to reshape the luggage market and drive demand for more advanced, high-tech products in the coming years.

**Regional Analysis**

The North America luggage market dominates the global landscape with a substantial market share of 35.5% in 2023, valued at approximately USD 13.7 billion. This dominance can be attributed to the strong consumer demand driven by high disposable income, the rising trend of frequent travel, and a growing preference for premium luggage brands. Additionally, the presence of key market players, along with robust retail distribution networks, bolsters the market growth in this region. The United States, in particular, remains a significant contributor, with a well-established tourism and business travel industry further propelling luggage sales.

Europe follows as a prominent player in the global luggage market, holding a share of 25% in 2023. The region benefits from a strong tourism sector, with countries like France, Germany, and the UK seeing high travel volumes, both domestic and international. The demand for durable, stylish luggage continues to grow, fueled by both leisure and business travelers. Asia Pacific, however, is witnessing the fastest growth trajectory, expected to register a CAGR of 7.2% from 2023 to 2030, driven by an expanding middle class, increasing travel frequency, and an expanding e-commerce market. This region’s increasing urbanization and rising disposable income levels significantly influence the demand for travel-related products.

In Middle East & Africa, the luggage market is evolving, with a focus on luxury and high-end luggage products in countries like the UAE and Saudi Arabia, which are becoming major hubs for international tourism. The market share in this region is projected to grow steadily, although it remains smaller compared to other regions, with a contribution of around 7% in 2023.

Latin America holds a market share of 6% in 2023, influenced by growing tourism, both inbound and outbound. Countries such as Brazil and Mexico are expected to drive regional growth, though economic challenges may pose constraints to rapid expansion.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, key players in the global luggage market continue to strengthen their positions through innovation and strategic expansions. Rimowa, a leader in high-end, durable luggage, maintains a strong brand image, driven by its premium offerings and collaborations with luxury brands. Samsonite, with its global reach, emphasizes functional, lightweight designs, reinforcing its market dominance. Tumi, known for its luxury and business-focused bags, appeals to affluent professionals through premium materials and advanced technology integration. American Tourister caters to the mid-market segment with affordable, stylish options that target younger travelers. Delsey differentiates itself with its French heritage, blending elegance with functional design, appealing to both fashion-conscious and practical consumers.

Travelpro remains a trusted name in frequent traveler luggage, especially in the business segment. Briggs & Riley excels with its lifetime warranty and durable, high-performance products. Victorinox combines Swiss engineering with sleek designs for the premium segment. Thule appeals to adventure travelers with durable, sport-oriented luggage. Heys offers cutting-edge design with a focus on the modern traveler’s lifestyle, maintaining a niche in fashionable, tech-savvy products. Each brand adapts to evolving travel trends, incorporating smart technology and sustainable practices to meet rising consumer expectations

Top Key Players in the Market

~~ Rimowa

~~ Samsonite

~~ Tumi

~~ American Tourister

~~ Delsey

~~ Travelpro

~~ Briggs & Riley

~~ Victorinox

~~ Thule

~~ Heys

**Recent Developments**

In 2024: Yatra Online, Inc. – India’s largest corporate travel services provider, announced the acquisition of Globe All India Services Limited (Globe Travels) for INR 1280 million (~USD 15.25 million). This strategic acquisition aims to bolster Yatra’s leadership in corporate travel solutions.

In 2023: VistaJet partnered with Italian luxury brand Valextra to launch an exclusive travel collection. This collaboration combines VistaJet’s aviation expertise with Valextra’s timeless design, offering premium travel accessories specifically tailored for the Global 7500 aircraft.

In 2024: Samsonite continued its sustainability initiatives with the “Luggage Trade-In Campaign”. From April 1 to May 31, customers could trade in old suitcases for a 30%–50% discount on new Samsonite products at participating stores.

In 2024: Vela Software Spain S.L. reaffirmed its commitment to data privacy by updating its privacy notice. The update outlines the company’s practices regarding the collection, use, and protection of personal data across its digital platforms.

In 2024: SITA expanded its services with the acquisition of ASISTIM, a leader in airline flight operations. This acquisition strengthens SITA’s capabilities in offering comprehensive operations-as-a-service solutions, aimed at enhancing efficiency and resilience for airlines worldwide.

**Conclusion**

The global luggage market is poised for substantial growth, driven by increasing travel activity, advancements in luggage technology, and evolving consumer preferences. With the market projected to reach USD 81.5 billion by 2033, the demand for both functional and stylish luggage continues to rise, particularly as consumers seek solutions that align with convenience, security, and sustainability.

Find More Reports that are Closely Related to this one.

Smart Luggage Market- https://market.us/report/smart-luggage-market/

Multi Utility Vehicle (MUV) Rental Market- https://market.us/report/multi-utility-vehicle-muv-rental-market/

Customized Travel Market - https://market.us/report/customized-travel-market/

Travel Agency Services Market- https://market.us/report/travel-agency-services-market/

Luxury Travel Market https://market.us/report/luxury-travel-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Travel & Tourism Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release