The Activism Vulnerability Report

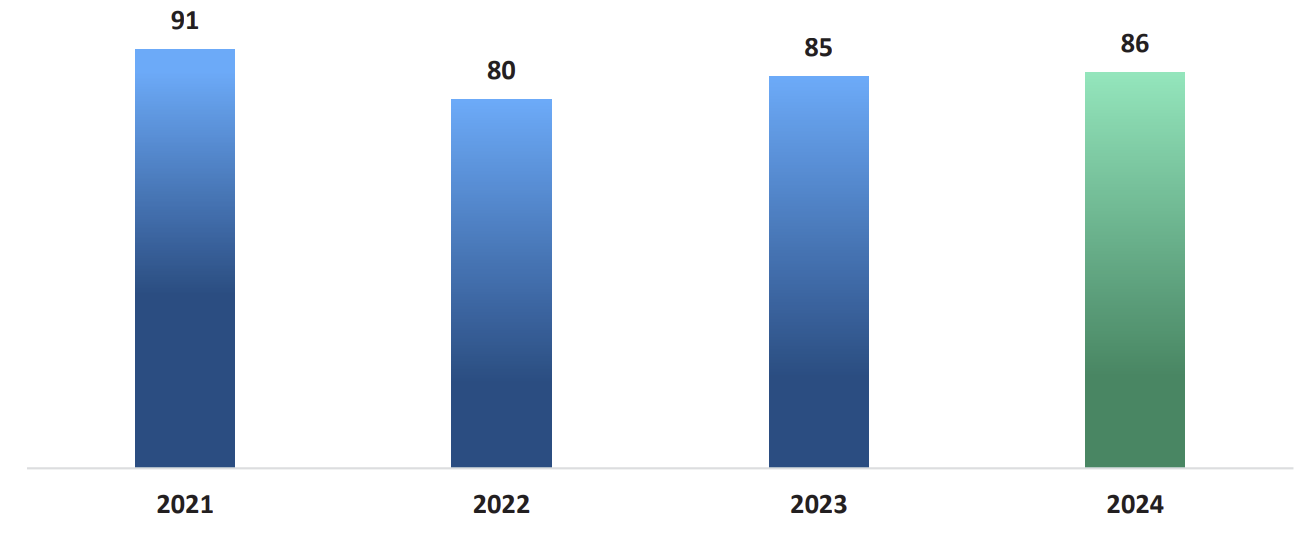

Activism industry headlines are deceptive; this quarter has been quieter than it appears. Despite several campaigns involving very high-profile companies receiving most of the media coverage, shareholder activism in the United States has been relatively quiet through the first five months of 2024. Increased valuations driven by strong U.S. equity markets last year, as shown by the S&P 500’s 26.3% total return, likely decreased the number of companies that activists found appealing.[1] Activists have gained 86 board seats year-to-date through May 31, similar to recent prior years.[2] Overall campaigns were down to a total of 123 relative to 139 in 1Q23, and relatively few campaigns resulted in full-scale proxy contests – fewer than 5% of total campaigns.[3]

Total Number of U.S. Board Seats Gained by Activists (YTD Through May)[4]

The vast majority of campaigns at U.S. companies with a market cap of $100 million or more end before they result in a full-scale proxy contest, which FTI Consulting defines as proxy contests that receive recommendations from both major proxy advisors: Institutional Shareholder Services (ISS) and Glass Lewis.[5] Lately, however, there has been an unusually large number of contests involving “mega caps,” or companies with market caps of $40 billion or more.[6] These include Starbucks, The Walt Disney Company (Disney), Norfolk Southern, and telecommunications infrastructure company Crown Castle. Activists won board seats in only one of the contests: Norfolk Southern.[7]

More broadly, activists have had an unusually low success rate in gaining board seats through full-scale proxy contests this year. As we discuss within, activists typically need recommendations from both ISS and Glass Lewis to gain one or more board seats. Only one activist has gained that, out of nine U.S. contests that have gone to a vote thus far this year: Ancora Advisors (“Ancora”), in its campaign focused on Norfolk Southern. The ninth and most recent U.S. contest was Medallion Financial vs. ZimCal Asset Management, which concluded on June 11.[8][9] ISS and Glass Lewis backed management nominees, and the Company rejected the activist’s bid for two board seats.[10][11][12]

Activists’ biggest success so far this year was north of the border, as activists successfully replaced a full slate of eight directors at Canadian apparel maker Gildan Activewear Inc. (“Gildan”). A group of investors led by Browning West sought to bring back ousted CEO Glenn Chamandy, who was let go by Gildan’s board last December. ISS and Glass Lewis each backed the activists’ full slate of eight directors. On May 23, just five days before Gildan’s AGM, Gildan’s entire board resigned, ceding their seats to the activists’ nominees.

Norfolk Southern

Ancora achieved a partial victory at Norfolk Southern in a highly publicized contest. Ancora won three of 13 board seats after ISS and Glass Lewis each supported at least five of its seven nominees. This campaign is broken out further in our “Flavors of Activism” section below.

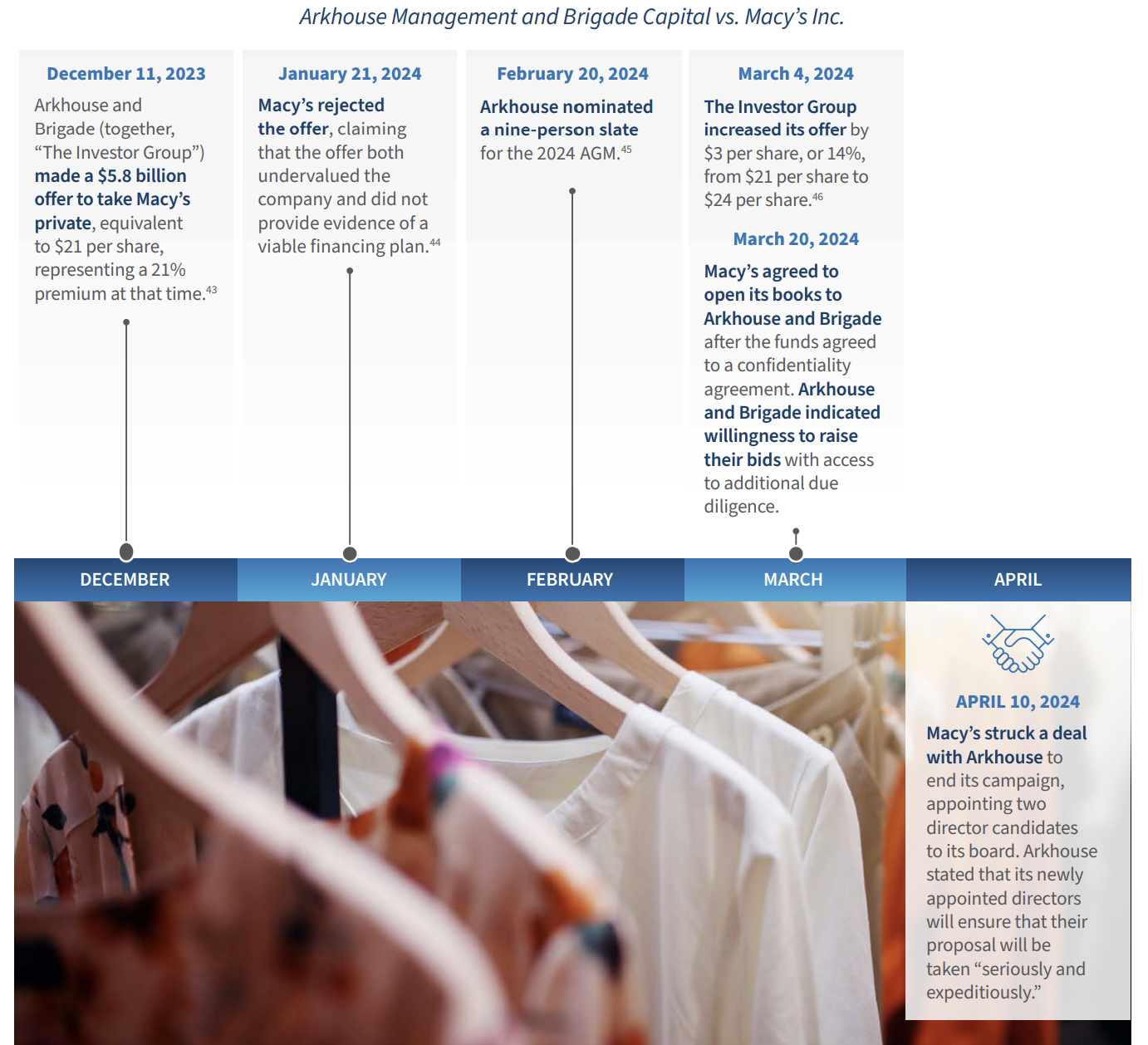

Macy’s

Macy’s Inc. (“Macy’s”) ceded two board seats in an agreement with Arkhouse Management (“Arkhouse”), which then pulled its proposed nine-director slate at the department store chain. Arkhouse and Brigade Capital Management (“Bridgade”) are still working to acquire Macy’s.

This campaign is also discussed further in our “Flavors of Activism” section below.

SilverBow Resources

After amassing a 14.7% stake in September 2022, Kimmeridge Energy Management (“Kimmeridge”) launched a campaign this February, putting forward a three-person slate at the oil and gas company. Kimmeridge also submitted several bids to purchase the company. Riposte Capital, another activist shareholder focused on SilverBow Resources Inc. (“SilverBow”), urged the company to enter negotiations with Kimmeridge after the board dismissed two acquisition bids.

In May, SilverBow entered into a $2.1 billion agreement to sell itself to Crescent Energy, at which time Kimmeridge ended its proxy contest.

Braemar Hotels & Resorts

Blackwells Capital (“Blackwells”) launched a campaign to refresh Braemar Hotel and Resorts Inc.’s (“Braemar”) board with four new directors. The AGM was postponed from May 15 until July 30, as Braemar contended that Blackwells had not complied with all legal requirements for its nominees to be validly considered. The two sides continue to litigate that claim pending the rescheduled AGM.

Crown Castle

Ted Miller, Crown Castle’s founder and former CEO, launched a bid through his Boots Capital Management (“Boots Capital”) investment vehicle to return as executive chairman and nominated three other directors to join him.[13] Miller called out issues with the company’s agreement with Elliott Management (“Elliott”) that subsequently resulted in modifications.

The proxy advisors issued a split recommendation, yet shareholders elected all 12 Crown Castle nominees on May 22.

The first quarter of 2024 was fairly quiet for activist investors in terms of total campaigns, with 123 recorded, representing a 12% decrease vs. 1Q23.[14] In our April 2024 report, we discussed how, through early March, campaign activity was on track to outpace previous years; however, activity for the full month of March was significantly cooler than in 2023. As was the case in prior years, settlements continued to account for nearly all board seats gained, or 97% of all board seats gained thus far in 2024.[15]

Campaign Total by Sector [16]

Financial Institutions

Financial Institutions remained the most active sector for activists in 1Q24, with 47 campaigns, a 24% yearover-year increase, representing 38% of total campaigns for the quarter. Within this sector though, the main targets shifted from regional banks to investment management firms, which represented 57% of all financial institution campaigns in 1Q24. BlueBell Capital ran an unsuccessful campaign to split the CEO and chairman roles at BlackRock Inc., but most asset management targets were otherwise small-caps. Demands consisted of corporate governance reforms (e.g., eliminate staggered board, separate CEO and chair or voting changes), board representation and returning capital to shareholders via share repurchases. Most targets were closed-end funds trading below net asset value (“NAV”), or campaigns we dub “fund campaigns,” which have been initiated more often in recent quarters.

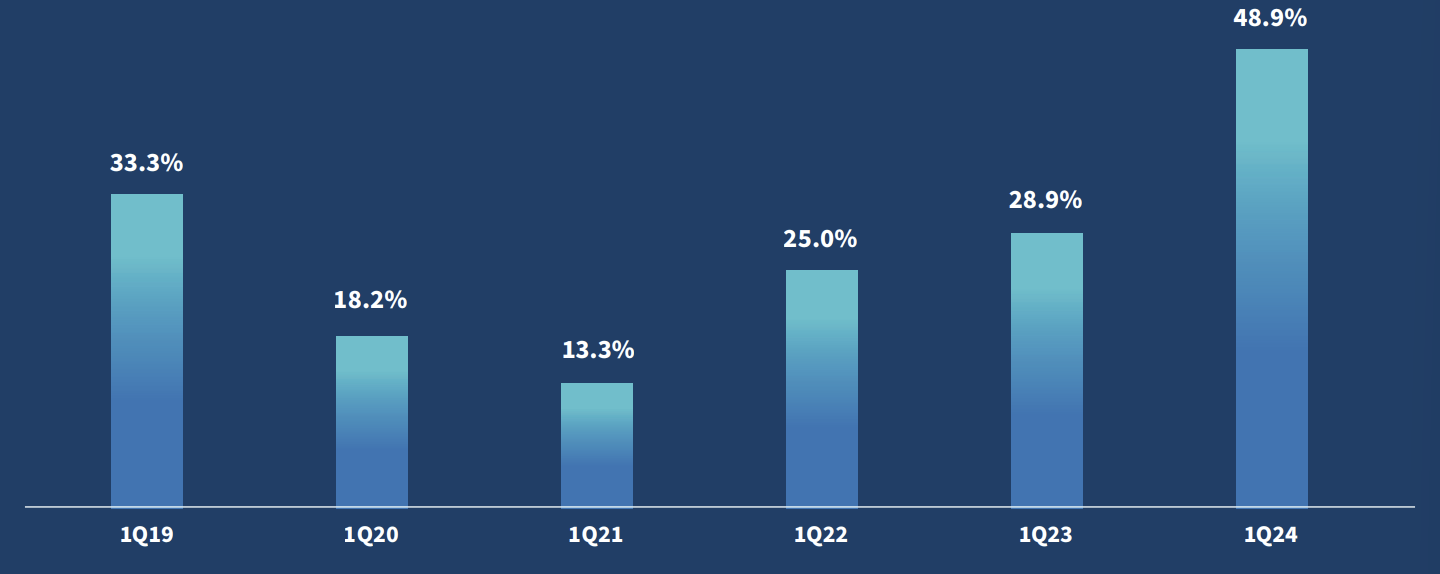

“Fund Campaigns” as a Percentage of Total Q1 Financial Institution Campaigns

Although there are plenty of ongoing campaigns, the success rate in the Financial Institutions sector is showing early signs of outperforming other sectors.[17]

Notable Campaigns:

— Bulldog Investors targeted DWS Municipal Income Trust for the underperformance of the fund, and subsequently the lack of action despite shares trading below NAV. The activist called upon the fund to launch a self-tender for at least 50% of its shares, “at or close to” the stock’s NAV.[18]

— Saba Capital Management (“Saba”) targeted numerous closed end funds and investment management companies, seeking board representation to address subpar performance, corporate governance inefficiencies and, in certain cases, close the gap between NAV and share price. Saba alone accounted for 24% of total 1Q24 investment management campaigns.[19]

Technology, Media & Telecom

The TMT sector remained active in 1Q24 with 22 total campaigns, representing 18% of total campaigns for the quarter. Activists’ demands in these campaigns varied widely and included board representation, disclosure of information, remedying operational and governance inefficiencies, M&A related demands and ESG focused proposals. Historically, TMT companies have been subject to operational demands, but such demands were not as prevalent in 1Q24 campaigns. Many more campaigns related to social issues such as political spending, diversity, and hiring practices.[20]

Although a large percentage of campaigns are still ongoing, early success rates in the sector were low. One-half of the campaigns launched in the sector targeted “large-cap” firms, or firms with market caps of $10 billion or greater. Of the 1Q24 TMT large-cap campaigns that have concluded, none were successful for activists, including Arjuna Capital vs. Applied Materials Inc., NorthStar Asset Management vs. Adobe Inc., and Trillium Asset Management vs. Verizon Communications Inc.[21]

Notable Mid-Cap Campaigns:

— Match Group was targeted by two activist funds during the quarter: Elliott and Anson Funds (“Anson”). Elliott targeted the company for share price underperformance, seeking board refreshment to unlock value.[22] Two months later, Anson entered the Match Group campaign as well, seeking a board refresh and suggesting the company invest more effectively in artificial intelligence (“AI”).[23] Shortly after Anson made its position public, the company settled with Elliott, naming two directors to its board.[24]

— Alight, Inc. (“Alight”) found itself in the crosshairs of Starboard Value (“Starboard”) in February after the activist sought to replace three incumbent directors.[25] Shortly thereafter, Alight announced the sale of its payroll and professional services business for $1.2 billion.[26] It later settled with Starboard, which received two board seats.[27]

As total campaigns decreased, so too did campaigns in all three market cap intervals. Small-cap campaigns decreased the least, with a year-over-year decrease of 6%, compared to 15% and 24% decreases in the largeand mid-cap intervals, respectively. Of the 40 total concluded small-cap campaigns thus far in 2024, 88% have resulted in at least partial victory for the activist, compared to 5% of concluded large-cap campaigns. Notably, the small-cap category still has the largest number of campaigns ongoing. Activists’ more frequent success with smaller companies is a trend we will continue to monitor.[28]

The Real Estate sector, which our screener ranked as the industry most vulnerable to activism, experienced several small-cap campaigns, such as Blackwells’s campaigns against Ashford Hospitality Trust and Braemar, Nitor Capital’s against Tejon Ranch Company, and K&F Growth Capital’s against Bally’s Corporation.

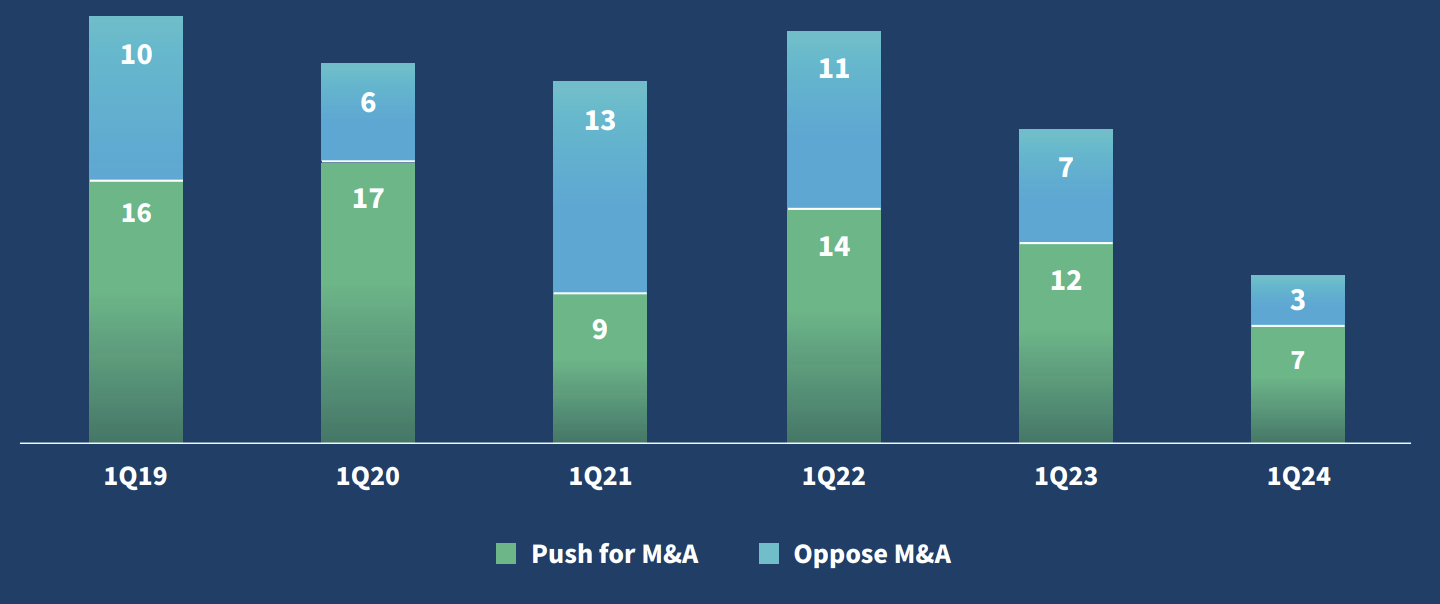

The U.S. and Canadian M&A market remained muted in 1Q24, seeing 3,765 transactions, a decrease of 21% yearover-year with an average value per transaction of $100.5 million, a 75% increase year-over-year. The Industrials sector had the largest volume of deals announced – 674 – representing 18% of all transactions.[29] Middle market M&A remained soft, and “mega-deals,” or deals over $1 billion in value, were in the spotlight.[30]

Significant 1Q24 Deals[31]

The soft M&A market was mirrored by the decrease in M&A demands in 1Q24. The 10 M&A demands for the quarter was the lowest in the last six years and was down 47% from last year.[32]

M&A Related Demands[33]

The results of the FTI Consulting Activism Vulnerability Screener for 1Q24 place Real Estate as the number one industry most vulnerable to shareholder activism. The previous top industry, Utilities, dropped to sixth, while the rest of the top five remained similar to last quarter and included Media & Publishing, Telecommunications, Aviation & Airlines and Biotechnology.

Unlike in our April 2024 report, there were no industries that shifted 10 or more places in the rankings, but there were a few notable moves that drew our attention. The Real Estate and Utilities industries traded places for the top spot, while the Life Sciences industry appeared substantially more vulnerable to activism, and multiple financial industries appeared less vulnerable to activism.

Real Estate Industry – Moved up 5 spots to 1st

The Real Estate industry continues to struggle under higher interest rates that dampen demand for sales and construction, in addition to the contraction in space leased by companies due to the continuation of flexible work arrangements that have seen fewer workers return to offices since the end of the pandemic.[34] Worsening total shareholder return (“TSR”), Balance Sheet and Operating Performance vulnerability scores pushed the industry’s composite score higher, as weaker financial results dragged down share prices.[35]

Notable campaigns in the Real Estate sector include Braemar, as previously mentioned, and Erez Asset Management’s attempt to obtain two board seats at Whitestone REIT (“Whitestone”), which owns shopping centers in Arizona and Texas.[36] Shareholders elected all of the company’s nominees at its meeting on May 14.[37] Within three weeks, though, Whitestone announced that the two targeted directors would step down from the board, once the company found suitable replacements.[38]

Utilities Industry – Moved down 5 spots to 6th

The Utilities industry dropped from the top spot last quarter down to sixth after improvement across all metrics measured by our screener. The solid results were driven mainly by strong TSR during the period as many investors bet that Utilities would benefit tremendously from the energy needs of the Data Center and AI industries.[39] From a recent low point on April 16, the Vanguard Utilities Index Fund exchangetraded fund has gained 15% through May 20.

Life Sciences Industry – Moved up 8 spots to 9th

In the first quarter, the Life Sciences industry grew more vulnerable across all four pillars of our composite score calculation, including Governance, TSR, Balance Sheet and Operating Performance. TSR was the main contributor to the industry’s increased vulnerability. The year-to-date return of the U.S. Select Medical Equipment Index is 5.1%, compared to a 12.8% return of the S&P 500.[40]

Financial Institutions Sector – Strong improvement in multiple industries

— Savings Banks Industry – Moved down 9 spots to 17th

— Regional Banks Industry – Moved down 6 spots to 30th

— Financial Conglomerates Industry – Moved down 9 spots to 32nd

Industry vulnerability scores within the Financial Institutions sector have been exceptionally volatile over the past few quarters. This movement can largely be attributed to the volatility of share prices of companies tracked within our screener.

The decrease in vulnerability has occurred even though interest rates continue at relatively high levels, and commercial real estate borrowers face the need to refinance maturing loans through the end of next year, a threat to many regional banks with less than $100 billion in total assets.[41] Higher for longer rates are also squeezing banks, as depositors demand a greater return on their deposits, forcing banks to ante up to prevent migration of capital.[42]

“Given the uncertainty around real estate values, combined with the stabilization of interest rates, it isn’t surprising that shareholder activism in the Real Estate sector has ramped up in 2024. That said, it is difficult to discern clear patterns for what is driving these activities other than the uncertainty itself. When will office values hit the bottom? When will interest rates decline? The answer to these questions remains unclear; however, there seems to be an increase in the desire of market participants to lean into the headwinds and to re-engage in transactions at new normal levels. Regardless, most market activity has varied depending not only on asset class and location, but also on specific asset characteristics.

On the one hand, it could be said that real estate values are meaningfully understated in some cases, especially in the public markets. Many real estate investment trusts (“REITs”) are currently trading at a discount to net asset value. Furthermore, some capital-intensive operating businesses are currently being valued at depressed multiples of earnings. In both cases, the value of the assets underlying these businesses can be greater than the current value of the businesses as a whole. As sponsors seek more creative approaches to generating suitable investor returns, divestiture trends are on the rise and there seems to be an uptick of bets being made that real estate values are simply misunderstood in select cases.

On the other hand, the Real Estate sector is currently experiencing an unprecedented loan maturity wall which will persist into 2025 and beyond. Lenders are having significant trouble re-financing maturing loans because market participants are not yet willing to come to terms with reset values. At the same time, lenders don’t want to foreclose on assets, leading to instances where activist investor groups have called for entire businesses to liquidate for fear that they cannot continue to operate as a going concern. This has been especially true in the office sector, where assets have traded for pennies on the dollar and a substantial amount of new capital expenditures are typically required to reposition properties in need.

Among the real estate companies most affected by shareholder activism year-to-date, it shouldn’t be surprising to see office property owners near the top of the list. Additionally, real estate service companies have risen to the forefront, as leasing and brokerage services have been extremely challenged. Among those least affected so far this year, owners of residential real estate (including multi-family apartments) and healthcare properties seem to be experiencing less disruption on a relative basis. All of that said, it’s hard to identify clear trend lines and, in most cases, a better understanding of the specific facts relating to each unique circumstance is needed to gain an understanding of the market.”

McRae Thompson, Senior Managing Director,

Leader of FTI Consulting’s Real Estate Tax Advisory practice

Industry watchers understand well that shareholder activism can take many forms. In 2024, we have already seen three separate forms of hostile takeovers: a take-private offer which almost became a proxy fight, a corporate acquisition that turned hostile, and a traditional proxy fight. All with the same goal of gaining control. Though the exact nature of each campaign has been different, all three appeared willing to take their bids all the way to a shareholder vote, whether those bids were welcome or not.

Macy’s directors seemed unwilling to engage in meaningful dialogue to negotiate a sale prior to Arkhouse proposing a slate of directors.[47] Though proxy contests often are not necessary to create change, the threat of one can expedite the process.

In this situation, even when a public company believes that making an acquisition would be beneficial, it must weigh other considerations. In addition to regulatory uncertainties, Choice had to consider the views of its own shareholders. Choice’s share price substantially underperformed the share prices of fellow hotel operators such as Hilton Worldwide Holdings Inc. and Hyatt Hotels Corporation, from late October 2023 until Choice withdrew its bid. When Choice withdrew its bid, its share price rose meaningfully.

This campaign represents the closest to a traditional engagement between a fund-side activist and an issuer, with the goal of enacting change in the business. We included this campaign because, although it was not marketed as a “hostile takeover” campaign, the nomination of a majority slate suggests otherwise.

The central theme of seeking control links all three campaigns. In its defense, Norfolk Southern enacted change on its own, attempting to take an arrow out of the activists’ quiver. The tactic was a partial success with Norfolk Southern ceding only three seats to Ancora, and CEO Alan Shaw surviving the vote.

As mentioned earlier, 2024 has seen several highprofile companies facing proxy contests. The results were largely disappointing for activists and encouraging for companies.

So far in the 2024 proxy season (which began September 1, 2023), activists have won at least one board seat in only one of nine full-scale proxy contests in the United States (11%). Over the previous seven proxy seasons, activists had an average success rate of 46%, the lowest being 29% in the 2021 proxy season.

Focusing on situations involving larger companies, our previous quarterly report featured the Starbucks and Disney campaigns, with activists winning board seats at neither. Ancora proposed seven nominees for Norfolk Southern’s 13-person board. Both ISS and Glass Lewis recommended for at least five Ancora nominees, yet only three Ancora nominees won.[60][61]

Boots Capital proposed four nominees for Crown Castle, but shareholders elected all companynominated directors.[62][63] Glass Lewis recommended that shareholders elect two Boots Capital nominees, while ISS endorsed the company’s entire slate.[64][65]

Such a split recommendation by proxy advisors has historically made it very difficult for an activist to win a board seat, as we have written about previously. FTI Consulting’s proprietary count of proxy contests looks at contests involving U.S. companies with at least $100 million market cap, where both ISS and Glass Lewis issued recommendations. From the 2017 through 2023 proxy seasons (Sept. 1, 2017 through Aug. 31, 2023), there were 97 such contests. In the 22 cases where proxy advisors split their recommendations, activists won a board seat in only three of those contests (14% success rate).

ISS and Glass Lewis have issued split recommendations in four of nine situations year-to-date, diverging 44% of the time. That is approximately twice the frequency with which they split recommendations in the past: 23% from the 2017 through 2023 proxy seasons. The 44% difference in recommendation among ISS and Glass Lewis is also higher than any prior year viewed in isolation; the highest frequency the proxy advisors split the vote was in 2019, when they differed four out of 11 times, or 36%.

This year’s number may simply be the result of a small sample size. But it may persist, which should help companies and hinder activists. The trend accentuates the benefits of well-executed defense tactics, with the support of one proxy advisor increasing success rates. On the other hand, as mentioned in the April 2024 Activism Vulnerability Report, it further signals to activists that proxy advisors seek a narrative that directly links a company’s shortcomings to its share price underperformance.

In a relatively quiet start to 2024 for activists, we saw a handful of prominent activists and companies engage in proxy contests, often with disappointing results for the activists due to split recommendations by the major proxy advisors. We also witnessed a continuation of the trend discussed in our April 2024 report, where activists struggled to find sufficient support against large-cap firms. Despite these apparent setbacks, in absolute terms, activists continue to wrangle board seats at a solid pace, and there remains ample opportunity across many industries to constructively engage and create shareholder value. We believe Real Estate, Media & Publishing and Telecommunications represent fertile grounds for investment, but we will follow closely wherever the action may move next.

The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates or its other professionals.

Endnotes:

4FTI Consulting analysis of Diligent data.(go back)

5FTI Consulting analysis of ISS and Glass Lewis recommendations.(go back)

8“ZimCal Announces Nomination of 2 Independent Directors and Preliminary Proxy Filing.”, Restore the Shine (April 12, 2024), ZimCal Activist Nominates 2 candidates to board of Medallion Financial Corp. — Restore the Shine.(go back)

9Medallion Financial Corp. form PREC14A, filed April 18, 2024. XBRL Viewer (sec.gov).(go back)

10“Independent Proxy Advisor Glass Lewis Recommends Medallion Shareholders Vote “FOR” Both of the Board’s Director Nominees on the BLUE Proxy Card”, GlobalNewswire (June 4, 2024), Independent Proxy Advisor Glass Lewis Recommends Medallion (globenewswire.com).(go back)

11“Leading Proxy Advisor ISS Recommends Medallion Shareholders Vote “FOR” Both of the Board’s Director Nominees on the BLUE Proxy Card”, GlobalNewsire (May 28, 2024), Leading Proxy Advisor ISS Recommends Medallion Shareholders (globenewswire.com).(go back)

12Medallion Financial Corp. form 8-K, filed June 11, 2024. XBRL Viewer (sec.gov).(go back)

13“Boots Capital Sends Letter to Shareholders Highlighting Crown Castle Board’s Failures to Deliver Promised Changes While Presiding Over a Decade of Underperformance”, PR Newswire (May 7, 2024), https://www.prnewswire.com/news-releases/boots-capital-sends-letter-to-shareholders-highlighting-crown-castle-boards-failures-to-deliver-promised-changes-while-presiding-over-a-decade-of-underperformance-302137505.html.(go back)

14Market data provided by Diligent as of June 3, 2024.(go back)

15Market data provided by Diligent as of May 28, 2024.(go back)

16FTI Consulting analysis of market data provided by Diligent as of June 3, 2024.(go back)

18Bulldog Investors LLP SEC Form 13D, filed March 19, 2024. https://www.sec.gov/Archives/edgar/data/839533/000150430424000004/third.txt.(go back)

19Market data provided by Diligent as of June 3, 2024.(go back)

20Market data provided by Diligent as of June 3, 2024.(go back)

22Kenneth Squire, “Activist Elliott spots an opportunity to restore growth at Match. Here’s what may happen next”, CNBC (January 13, 2024), https://www.cnbc.com/2024/01/13/activist-elliott-spots-an-opportunity-to-restore-growth-at-match-heres-what-may-happen-next.html.(go back)

23Crystal Tse, Natalie Lung, ”Match Group Attracts Second Activist, Anson Funds”, Bloomberg (March 14, 2024), https://www.bloomberg.com/news/articles/2024-03-14/match-group-is-said-to-attract-to-second-activist-anson-funds?embedded-checkout=true.(go back)

24Rohan Goswami, “Match adds two directors in deal with activist investor Elliott Management”, CNBC (March 25, 2024), https://www.cnbc.com/2024/03/25/match-adds-two-directors-in-deal-with-activist-investor.html.(go back)

25Svea Herbst-Bayliss, “Activist hedge fund Starboard targets benefits services provider Alight”, Reuters (February 21, 2024), Activist hedge fund Starboard targets benefits services provider Alight | Reuters.(go back)

26”Alight to sell payroll and professional service business for up to $1.2 billion”, Reuters (March 20, 2024), “Alight to sell payroll and professional service business for up to $1.2 billion”.(go back)

27”Alight Names Two New Independent Directors, Dave Guilmette and Coretha Rushing, to its Board of Directors”, BusinessWire (May 6, 2024), Alight Names Two New Independent Directors, Dave Guilmette and Coretha Rushing, to its Board of Directors (yahoo.com).(go back)

28Market data provided by Diligent as of June 3, 2024.(go back)

29Ingrid Lexova and Annie Sabater, “North American M&A ends Q1 2024 on a gloomy note”, S&P Global (April 16, 2024), North American M&A ends Q1 2024 on a gloomy note | S&P Global Market Intelligence (spglobal.com).(go back)

30Hagen Rogers, “U.S. Mergers and Acquisitions: First Quarter Recap”, Watermark Advisors (May 14, 2024), U.S. Mergers & Acquisitions: First Quarter Recap – Watermark Advisors.(go back)

32Market data provided by Diligent as of June 3, 2024.(go back)

33FTI Consulting analysis of market data provided by Diligent as of June 3, 2024.(go back)

34“Expert Voices 2024, Remote Work: Its Impact on Cities,” PennIUR (January 8, 2024), https://penniur.upenn.edu/publications/expert-voices-2024.(go back)

35Jessi Healy, “Here’s who sank and who soared in Q1 2024 earnings,” Inman (May 9, 2024), https://www.inman.com/2024/05/09/heres-who-sank-and-who-soared-in-q1-2024-earnings/.(go back)

36“EREZ ASSET MANAGEMENT SENDS LETTER TO WHITESTONE REIT SHAREHOLDERS COMMENTING ON THE BOARD’S LACK OF CANDOR,” PR Newswire (April 26, 2024), EREZ ASSET MANAGEMENT SENDS LETTER TO WHITESTONE REIT SHAREHOLDERS COMMENTING ON THE BOARD’S LACK OF CANDOR (prnewswire.com).(go back)

37Whitestone REIT form 8-K, filed May 17, 2024. XBRL Viewer (sec.gov).(go back)

38“WHITESTONE REIT CONTINUES BOARD REFRESHMENT,” Whitestone REIT Investor Relations (June 3, 2024), Whitestone REIT Continues Board Refreshment | Whitestone REIT.(go back)

39David Uberti, “The Unlikely Stocks That Became a Hot Bet on AI,” The Wall Street Journal (May 21, 2024), https://www.wsj.com/finance/stocks/stock-market-hottest-industry-utilities-45907c48.(go back)

40Market data provided by FactSet as of June 9, 2024.(go back)

41Stephanie Landsman, “Regional bank earnings may expose critical weaknesses, former FDIC Chair Sheila Bair warns,” CNBC (April 16, 2024), https://www.cnbc.com/2024/04/16/regional-bank-failures-may-be-ahead-fmr-fdic-chair-sheila-bair-warns.html.(go back)

42Madison Faller, “One year later: Bank failures and lessons learned,” J.P. Morgan Private Bank (March 15, 2024), https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/tmt/one-year-later-bank-failures-and-lessons-learned.(go back)

43Diligent, Diligent Market Intelligence (insightia.com).(go back)

47Jennifer Marks, “Effort to privatize Macy’s quietly rolls forward”, Home Textiles Today (May 9, 2024), https://www.hometextilestoday.com/financial/effort-to-privatize-macys-quietly-rolls

48“Wyndham board unanimously rejects $8 billion unsolicited buyout offer from Choice Hotels,” CNBC (October 17, 2023), https://www.cnbc.com/2023/10/17/choice-hotels-offers-nearly-8-billion-for-larger-rival-wyndham-hotels-resorts-as-travel-booms.html.(go back)

49FactSet, price data as of December 12, 2023.(go back)

50Wyndham IR, “No Room for Wrong Choice”, Wyndham Hotels Investor Relations (December 20, 2024), https://corporate.wyndhamhotels.com/wp-content/uploads/2023/12/No-Room-for-Wrong-Choice_Infographic.pdf.(go back)

51Diligent, Diligent Market Intelligence (insightia.com).(go back)

52Aishwarya Jain, Doyinsola Oladipo and Anirban Sen, “Choice Hotels Abandons Roughly $7 Billion Takeover Bid for Wyndham,” Reuters (March 11, 2024), https://money.usnews.com/investing/news/articles/2024-03-11/choice-ends-hostile-bid-for-wyndham-hotels.(go back)

53Diligent, Diligent Market Intelligence (insightia.com).(go back)

60Esther Fung, “Norfolk Southern Chief Survives Activist’s Push to Oust Him”, Wall Street Journal (May 9, 2024), https://www.wsj.com/business/c-suite/norfolk-southern-shareholders-vote-thursday-to-keep-or-fire-ceo-21c434fc.(go back)

61Dean Seal, “Glass Lewis Backs 6 Activist Nominees for Norfolk Southern’s Board”, Wall Street Journal (April 29, 2024), https://www.wsj.com/business/logistics/glass-lewis-backs-6-activist-nominees-for-norfolk-southerns-board-ba2add85?mod=article_inline.(go back)

62Crown Castle, Inc. 2023 Annual Report, https://www.sec.gov/ix?doc=/Archives/edgar/data/1051470/000105147024000062/cci-20231231.htm.(go back)

63“Crown Castle Wins Proxy Contest With Boots Capital”, Paul Weiss client news (May 22, 2024), https://www.paulweiss.com/practices/transactional/corporate-governance/news/crown-castle-wins-proxy-contest-with-boots-capital?id=51594.(go back)

64“Leading Proxy Advisory Firm Glass Lewis Recommends Crown Castle Shareholders Vote “For” Boots Capital Nominees Ted B. Miller and Charles C. Green”, Boots Capital Management press release (May 14, 2024), https://www.prnewswire.com/news-releases/leading-proxy-advisory-firm-glass-lewis-recommends-crown-castle-shareholders-vote-for-boots-capital-nominees-ted-b-miller-and-charles-c-green-302144088.html.(go back)

65“Institutional Shareholder Services Supports Crown Castle Board Nominees”, Market Screener (May 13, 2024), https://www.marketscreener.com/quote/stock/CROWN-CASTLE-INC-19476277/news/Institutional-Shareholder-Services-Supports-Crown-Castle-Board-Nominees-46706406/.(go back)

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.